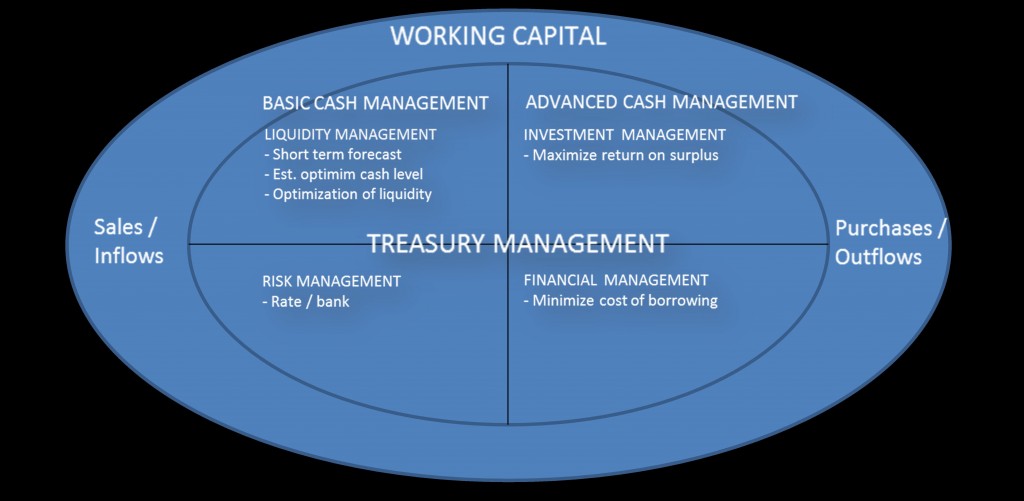

The goal of Treasury Management is to maximise the client’s liquidity to ultimately increase the yield without increasing the risk. This is done by way of liquidity management, investment structuring and effective administration. We use a two tier approach to the overall function of Treasury Management:

- Basic Cash Management includes short term forecasting of cash on hand and interest rates. Our proprietary models are then used for optimization of liquidity whilst at the same time establishing an optimum investment profile to address both cash flow and yield.

- Risk Management is of the utmost importance and this is why investments are made directly in the name of the client. This ensures that there is no 3rd party risk. We only invest with the top 5 SA banks but have relationships with international banks should the there be a need.

- Advanced Cash Management includes the actual investment management. At Fulcrum we only deal direct with the Treasuries of the various banks and as a result, together with our total assets under management, have a competitive advantage to source highly competitive rates.

HCI Products

- Unit Trusts

- Portfolio Management

- Online Trading

| Unit Trusts | Portfolio Management | Treasury Management |